RevOps Co-op Weekly #44 - Top 3 Considerations of an Acquisition or Merger

Jamie Klanac, Vice President of Revenue Operations at Transflo, shares his wealth of experience from managing over 20 acquisitions in our latest video interview.

RevOps Co-op provides resources, content and community for those who ❤️ revenue operations. This weekly newsletter features collected tweets, posts and thoughts on a variety of RevOps topics. We also have a private Slack community with > 2,500 RevOps pro’s from companies like Slack, Lyft, Clari, Miro and more 👉🏻 click here to join.

🚨Community Announcements!🚨

Just Launched! 1:1 connections with other RevOps pros from the RevOps Co-op!

We have teamed up with Meetsy 👋 to curate introductions, connections, and the secret sauce of serendipity within our community.

It's super easy to use, syncs with your calendar, and will curate meeting intros based on the criteria you provide at a cadence you determine.

Get your invite here and start connecting!

Top 3 Considerations of an Acquisition or Merger

Jamie Klanac, Vice President of Revenue Operations at Transflo, shares his wealth of experience in managing mergers and acquisitions. During his nine years at IBM, Jamie managed the sales operations integrations unit and oversaw over 20 acquisitions.

Protect Your Assets

“Assuming it's not an intellectual property acquisition where you're just buying the technology, the number one asset you’re acquiring is the sales team. Preventing regrettable attrition is key,” said Jamie.

Anyone who has worked in an acquired company can tell you that insecurity and nerves heighten at the time of the announcement. People worry that the acquiring company will lay them off or change the culture and they'll no longer enjoy the environment. Salespeople tend to be the most on edge. Not only are they worried about keeping their jobs, but they're also concerned that the way they are paid will be changed and that commission checks will be delayed.

"At IBM, we would typically look to make sure that their process was at least somewhat SOX compliant and had some governance in place. We would initially leave them on their old compensation plan, so we didn't change how they were paid. We needed them to continue selling more. That's why we acquired their company.

"Typically, we would keep them on their old plan for the fiscal year. If their plan was complicated, we might leave them on it a little longer. We looked at things like their base compensation and banding. Titles also matter. Culture matters. It's hard to adjust to being one of 200 people in a small company to one of 400,000."

Whether you're in the acquired company or acquiring company, sales managers must hear how compensation will be handled ASAP and socialize it with their teams. The faster salespeople hear their pay will not be disrupted or changed, the quicker they can regain their focus on selling.

If you want to maintain focus and build some excitement, get creative and figure out a way to provide extra value ($$) to the sales team.

"At IBM, we would do what we called synergy plans. We purchased the incoming companies because their technology was complimentary. Think about it. We had a customer base that they probably don't have, and we incentivized our team to make some opportunity identification. We introduced spiffs or bonuses for the IBM colleagues. On the other side, we would have the newly acquired company socialize IBM products and services. $500 for passing a lead is a pretty good deal."

Acquiring a New Region? Talk to an Expert

Unfortunately, the United States is one of the easiest (if not the easiest) countries to fire someone in. Most countries have complex laws around hiring and compensation that protect the employee over the corporation. In the United States, we take corporate personhood to extremes not seen in most areas of the world.

Americans who have never worked with an International are often shocked when they try to fire someone in France and have to pay them a salary for an additional year.

To avoid any surprises, make sure to speak with some experts.

“There's a lot of education that has to go into acquiring a company that has a customer base in new regions. One of the benefits of working for IBM was the depth and breadth of IBM’s market. You had to understand the enablement, product enablement, sales enablement, and all of the quirks that come with a new region.

“Culture matters. I lived in Asia for years and learned a ton. You learn so much more when you live there and you're with the people.

“It’s very important that integration between companies is smooth, which may mean using kid gloves when it comes to new geographies.”

Remember, CRMs Can Be a Touchy Subject

When I asked what aspect of an acquisition tended to be the most painful, he didn’t hesitate.

“Integrating the CRM.

“Systems are very emotional for sellers. They like their process, their icons, and they don’t like change. There were times when we could adopt some of the acquired companies’ CRM workflows because it was best of breed. But as a company the size of IBM, some of the tools couldn’t scale to our size or integrate with what we had in place.

“Most of the acquired companies were on Salesforce, and at the time, IBM was either on Siebel or SugarCRM. The acquired teams viewed being forced to adopt Siebel or SugarCRM as going back to horse and buggy times. It does matter that they see the CRM they have to use as a productivity tool, and we knew we were changing everything up. We tried to meet them halfway and make sure there was give and take in what we would bring into our CRM.”

If you're dealing with two organizations on the same CRM or the incoming organization can view your CRM as an upgrade, you would think integration would be easy. But it's not. People get attached to doing things a certain way.

"We acquired a company with $10 million ARR. They had one product, but it took us a while to integrate because they had so many processes hanging off of the opportunity. Fortunately, we were nimble enough to accommodate them. But a company like IBM will wrestle with whether or not to allow a company to keep using their existing system or adopt the larger company's processes.

"It's not just the systems. We have to worry about retaining the resources in RevOps. It's important that we keep them in their role because they're subject matter experts, and it's the right thing to do."

Tread carefully, use emotional intelligence, and view the acquisition process as a negotiation rather than a dictatorship.

Watch the full RevOps Co-op Video Interview here 👉 Top 3 Considerations of an Acquisition or Merger

🗣 Community Conversations

#04_revops-questions

Heya all! Does anyone have a recommendation for Proposals/Quotes/Sales Orders generation tool? We are currently using DocuSign Gen to generate docs for signature in Salesforce but it is extremely buggy and their support team is not very helpful. Read 8 responses.

#08_tools-and-software

Anyone have a lot of experience with tableau and calculated fields?

I have a view with QoQ revenue and I’m trying to calculate Net Dollar Retention . I’m not sure how to do a field that divides the measure by the previous quarter’s value. Offer your experience.

Any SFDC gurus willing to chat with me about the ideal structure of a Flow for bulk updating Lead fields based on other field values? I'm referencing a Country field and based on the value, it should update a Region picklist with 1 of 4 options (AMER, APAC, EMEA, Unknown). Read 7 responses.

Log in to contribute to the conversation!

🐦 This week in #RevOps Twitter

OR - Me watching an end user trying to use CPQ 🤣

Mic drop. 🎤

🦄✨🦄

📅 Upcoming Events

Webinar: The RevOps Battle - How to Move from a Supporting to Strategic role as RevOps? - Wednesday, August 25 @ 10am PT (1pm ET)

Join RevOps Co-Op partners Siva Rajamani - Co-founder & CEO of Everstage and Adithya Krishnaswamy - Head, RevOps & Growth of Everstage on August 25 at 10 am PT | 1 pm ET and demystify the move from a supporting role in RevOps to a strategic role.

📚 Your curated #RevOps reading list

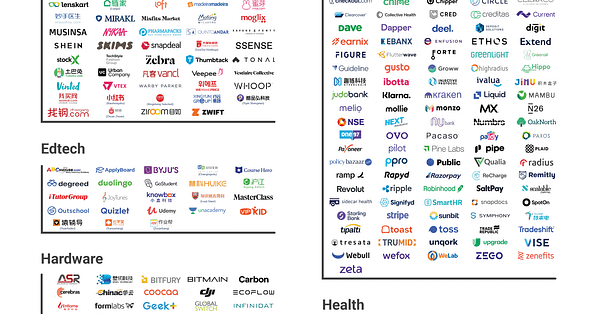

Choosing the Right CRM for Your Startup | Built In

If there’s one thing sales teams aren’t lacking for these days, it’s tools. There are tools for prospecting, automating emails, making phone calls and recording them. There’s software for signing contracts and for tracking a customer’s life cycle with the company. At the center of this galaxy sits customer relationship management software.

How We Use Activity-based Sequences to Reduce Churn | Outreach

Good retention relies on your ability to get in front of the problem. At Outreach, we’re using activity-based customer health warnings to catch and solve problems early. With effective triggers and a proven retention workflow, I’ve seen companies increase their retention rates from 85 to 90%, saving tens of millions of dollars in revenue. Want to know how it works?

Problems in the Pipeline: Why the Difference Between Pipeline & Forecast Matters | LeanData

Repeated studies have shown that salespeople spend well over half their time on non-revenue generating activities. That’s an astounding figure, and it has led to the increased adoption of automated solutions to free salespeople from manual and repetitive non-selling tasks. The idea is simple: more time spent on selling activities equals more sales, right? Not so fast! As experienced revenue team professionals know, it’s the right activities that engage the right contacts at the right accounts at the right times that add the most value.

🚒 RevOps Meme of the Week

🔥 A few HOT #RevOps Jobs

Demand Gen Specialist/Manager - MadKudu

Head of Growth Marketing- RevOps, Inc.

Sr Manager, Revenue Data Analytics - Brandfolder

Sales Operations Analyst - Cobalt

Sr Revenue Operations Analyst - Percona

RevOps Manager - Cloudsmith

Funnel IQ is an operating system for your GTM team that provides end-to-end, full funnel analytics and insights that keep marketing, sales and customer success teams aligned and working seamlessly together to drive more revenue growth for your business.